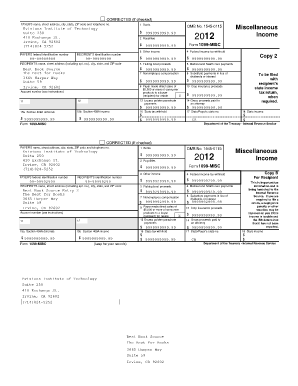

1099 Misc Pdf Fillable

What is a 1099-Misc Form? Download PDF File. Once you've received your copy of the fillable 1099 form from the IRS, you'll want to familiarize yourself with the various fields, or boxes to be filled in, on the form. Upon first glance, it might seem like the IRS has packed a large number of fields onto. Is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement. You also may have a filing requirement. See the Instructions for Form 8938.

At least $600 in rents, services (including parts and materials), prizes and awards, other income payments, medical and health care payments, crop insurance proceeds, cash payments for fish (or other aquatic life) you purchase from anyone engaged in the trade or business of catching fish, or, generally, the cash paid from a notional principal contract to an individual, partnership, or estate; Any fishing boat proceeds; or Gross proceeds of $600 or more paid to an attorney. See Payments to attorneys, later.

In addition, use Form 1099-MISC to report that you made direct sales of at least $5,000 of consumer products to a buyer for resale anywhere other than a permanent retail establishment. You must also file Form 1099-MISC for each person from whom you have withheld any federal income tax under the backup withholding rules regardless of the amount of the payment.

1099-misc Pdf Fillable 2014

Be sure to report each payment in the proper box because the IRS uses this information to determine whether the recipient has properly reported the payment.

What do you need to know about free software?

Form 1099-MISC 'Miscellaneous Income' is the form that businesses used to report payments to those who is called 'non-employees' by the IRS. The form is easy to fill. Here are a few tips on filling the 1099 misc 2018.

1. Taxpayer Identification Numbers: The IRS has required clearly on how to report the information of the recipient on the 1099. For both a sole proprietor and single member LLCs, use their individual name and their social security number. LLCs and sole proprietors may have Employer Identification Numbers (EIN), however, it may leads to some unsureness for the IRS by using the EIN. Therefore, it is the best to use social security numbers, so that the IRS can match the 1099 to individual tax returns where the income is reported.

2. Items that required in a 1099 include payments for services (such as professional, accounting, repair and maintenance, legal, web and graphic design, and computer services), prizes and awards, rent, or attorney fees. Please contact DBM to order 1099 forms or to ask for a detailed list of the expenses that may spark a required 1099.

3. Deadline: If you report a non-employee payment, the 1099-MISC will be paid by the payee and the IRS before January 31, 2018. They can be printable 1099 form (paper-filed, if you are filing under 250 forms) or electronically filed.